NVDY declined 21% from August to December despite distributing $11.91 per share over the past year.

66% of the most recent distribution was return of capital rather than investment gains.

The fund’s beta of 2.28 creates full downside participation while capping upside at sold call strikes.

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

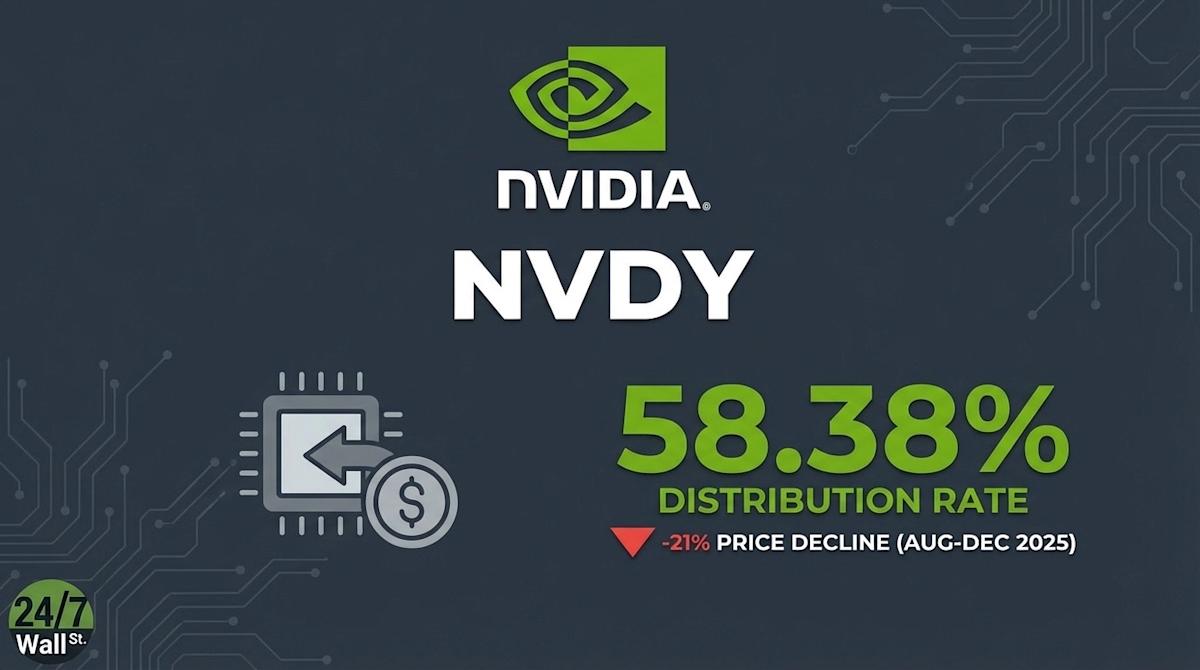

YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY) attracts income-focused investors with weekly distributions generated from Nvidia (NASDAQ:NVDA). The fund uses a synthetic covered call strategy, selling call options and spreads to capture premiums while maintaining exposure to the chipmaker’s price movements. With a 58.38% distribution rate as of December 10, 2025, NVDY offers income that dwarfs traditional dividend strategies. But the fund’s 21% decline from its August peak to $14.10 raises a critical question: are investors earning income or receiving their capital back in installments?

NVDY produces distributions by selling call options on Nvidia shares without holding NVDA stock directly. It uses long-dated call options to create synthetic exposure while selling shorter-term calls to collect premiums. This generates substantial income during high volatility, as option premiums increase when prices swing dramatically.

Recent distributions illustrate this variability. NVDY paid $0.15 per share on December 12, following payments of $0.16 and $0.15 in prior weeks. However, the fund paid $0.80 on October 10 and $0.32 on November 7. The fund transitioned to weekly distributions in October 2025 after previously paying monthly, providing more frequent but inconsistent income.

NVDY’s income generation comes with capped upside and full downside participation. While the fund distributed approximately $11.91 per share over the past year, creating an 84% yield based on current price, the ETF declined from $17.86 in August to $14.10 in December. Investors experienced both generous distributions and substantial capital erosion.

The challenge stems from Nvidia’s recent volatility. The stock declined 20% from its October peak of $212 to a November low of $170. When NVDA rallies sharply, NVDY’s upside is capped at sold call strike prices. When NVDA declines, the fund participates fully in losses. The 1.27% expense ratio adds additional drag.

finance.yahoo.com

#NVDY #Offers #Yield #Nvidia #Exposure #Investors #Capital