An economic metric can simultaneously be getting worse and be good. It can also be both better and bad.

That’s because “worse” and “better” are relative terms, while “good” and “bad” are absolute terms.

Kind of like when you’re recovering from illness. You sometimes start feeling better than yesterday while still feeling crummy overall.

Maybe you used to run a six-minute mile. But now it takes you seven minutes. Your time got worse, but it’s not bad.

The state of household finances can be described as getting worse, but still good.

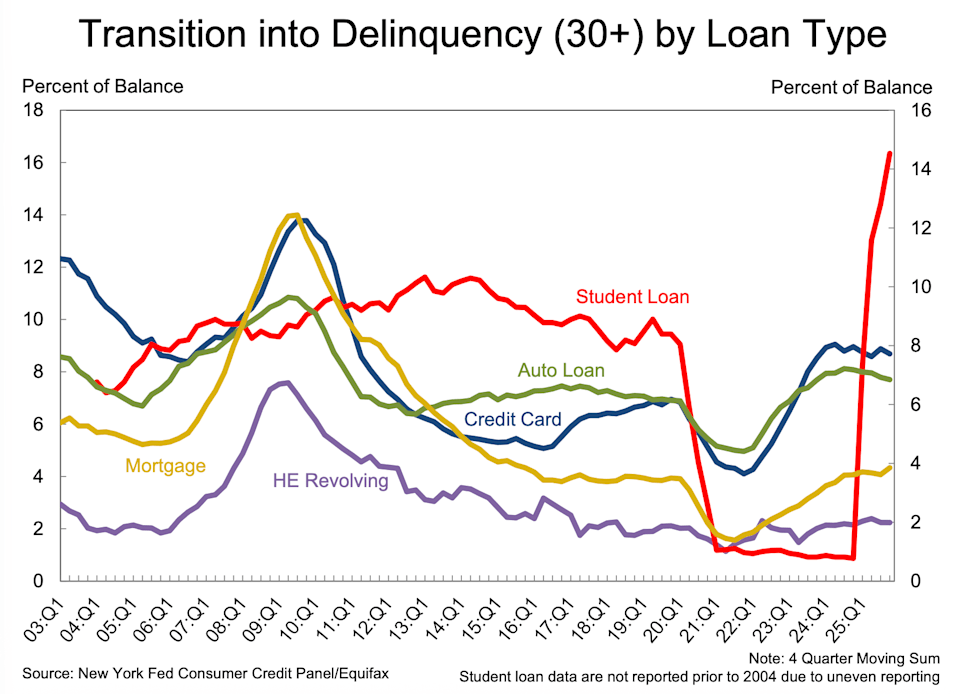

According to the New York Fed’s new , the amount of mortgage and student loan debt transitioning into early delinquency rose in Q4. Regarding the outsized swing in student loans transitioning into delinquency, NY Fed researchers that it “reflects continued effects from the resumption of payment reporting following the extended pandemic forbearance period.”

Delinquency rates held mostly steady for auto loans, credit cards, and home equity loans during the period. Still, delinquency rates for all forms of debt have worsened from their lows just a few years ago.

The chart showing the total amount of debt in some stage of delinquency is less alarming than the charts showing the rates of transition into delinquency. Still, 4.8% of outstanding debt, the total amount of debt in delinquency is the highest since 2017.

To be clear, all these metrics have gotten worse. I don’t think anyone’s disputing that.

However, these metrics mostly reflect financial health seen during the prepandemic economic expansion.

In other words, what we’ve experienced in is household finances from unusually strong levels to relatively worse levels that are arguably still good.

This explains why economic activity metrics like have continued to climb during this period of deteriorating finances. Americans , and they’ve .

“Consumer debt grabbed headlines [Tuesday] as total delinquent debt rose to 4.8% in 4Q 25, its highest since 2017,” BofA’s Shruti Mishra wrote. “This raised some alarm bells, particularly with mortgage delinquencies ticking up for lower-income households. However, the risk posed by increasing delinquent debt remains limited, in our view. Seriously delinquent debt-to-income is around 2.5%, roughly in line with levels seen in 4Q 19 and far from the near 10% levels seen in 2009 and 2010.”

finance.yahoo.com

#economic #data #worse #good