Meme coin DOGE extended its slide on Monday, falling through support levels and triggering fresh selling interest as broader market risk appetite collapsed.

What to Know

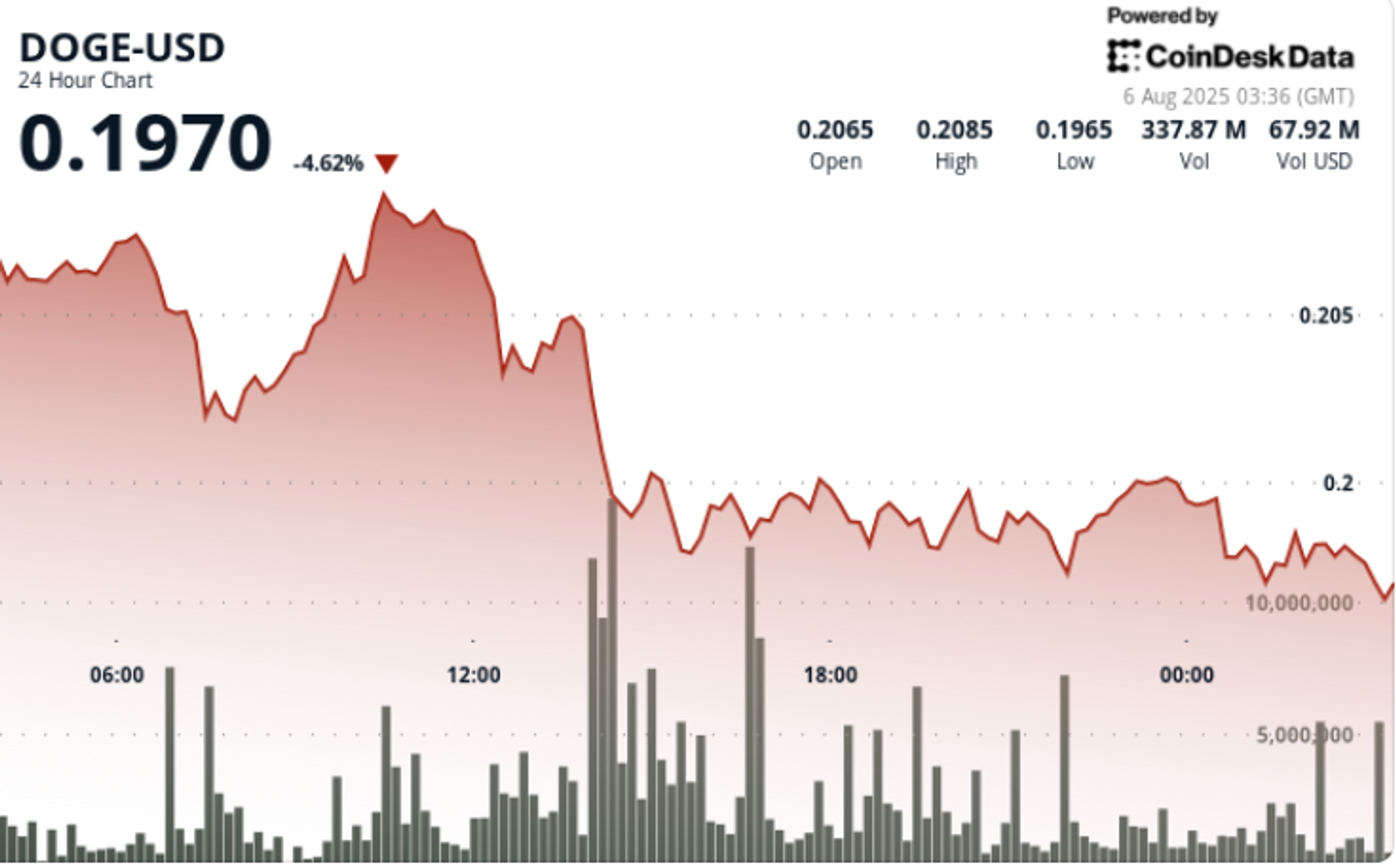

Dogecoin fell 5% over the 24-hour session from August 4 at 21:00 to August 5 at 20:00, declining from $0.21 to $0.20. The token traded within a $0.013 range, with lows of $0.198 and highs of $0.211. A key liquidation event occurred during the 14:00 hour on August 5, with volumes reaching 877.9 million — nearly 4x the 24-hour average of 268.85 million — triggering a breakdown below $0.205.

DOGE ended the session at $0.1985 after failing to reclaim higher resistance zones, signaling continued institutional selling and confirming new downside momentum. The move comes amid broader crypto market weakness triggered by risk-off sentiment across global equities.

News Background

DOGE’s decline coincided with institutional outflows from crypto-linked ETFs totaling $223 million over the past week, per CoinShares data. Federal Reserve hawkishness and renewed geopolitical concerns — including retaliatory tariffs and commodity flow disruptions — have fueled risk aversion across both traditional and crypto markets.

At the same time, the meme coin sector remains under pressure as retail enthusiasm fades and large holders continue to rotate into higher-beta altcoins or cash positions. DOGE had previously shown signs of accumulation last week, but failure to hold the $0.205 level invalidated the setup.

Price Action Summary

DOGE began the session strong, hitting $0.211 at 01:00, but reversed sharply through the day. The steepest decline occurred at 14:00, when price dropped from $0.205 to $0.199 amid 877.9 million in volume. By 19:51, another flush to $0.1975 occurred on 19.04 million volume — more than 70x the hourly average — before a shallow bounce to $0.1985 into the close.

New resistance has formed near $0.205, with price unable to sustain any recovery above that level following the breakdown. The token currently trades near session lows and shows no confirmation of a reversal.

Technical Analysis

- DOGE traded within a 6% range between $0.198 and $0.211

- Volume spiked to 877.9 million at 14:00, nearly 4x above daily average

- Rejection at $0.205 triggered mid-session breakdown

- Support attempted at $0.198-$0.199, but volume on bounce remained weak

- Final hour saw 19.04M volume burst at $0.1975 level, creating local resistance at $0.1988

- Momentum remains to the downside unless price reclaims $0.205 on convincing volume

What Traders Are Watching

Traders are closely watching whether DOGE can stabilize above $0.198 or face further downside toward $0.185. Failure to recover above $0.205 may extend liquidations. With volumes spiking on down moves and fading on recoveries, sellers remain in control unless macro risk sentiment improves or ETF outflows reverse.

www.coindesk.com

#DOGE #Sheds #Volume #Quadruples #Testing #Key #Support #Zones