Ethereum rallied past $3,700 earlier on Aug. 5 as whale and institutional accumulation intensified. Can it recover back above $3,800 by the end of the week?

Summary

- Ethereum remains 148% above its year-to-date low despite recent volatility.

- New whale wallets have scooped up over $3 billion in two days.

- Macro uncertainty and ETF outflows continue to cap upside momentum for ETH.

According to data from crypto.news Ethereum (ETH), the leading altcoin by market cap, rose 5.7% to an intraday high of $3,730 on Tuesday, Aug. 5, before settling back at $3,650 at press time. Its price is currently 148% above its year-to-date low.

The recent surge comes just weeks after Ethereum attempted to break above the $4,000 mark in late July but was rejected near $3,900 due to macro headwinds that ate into institutional risk appetite and a notable decline in total value locked across its ecosystem.

ETH is seeing renewed whale accumulation and institutional inflows

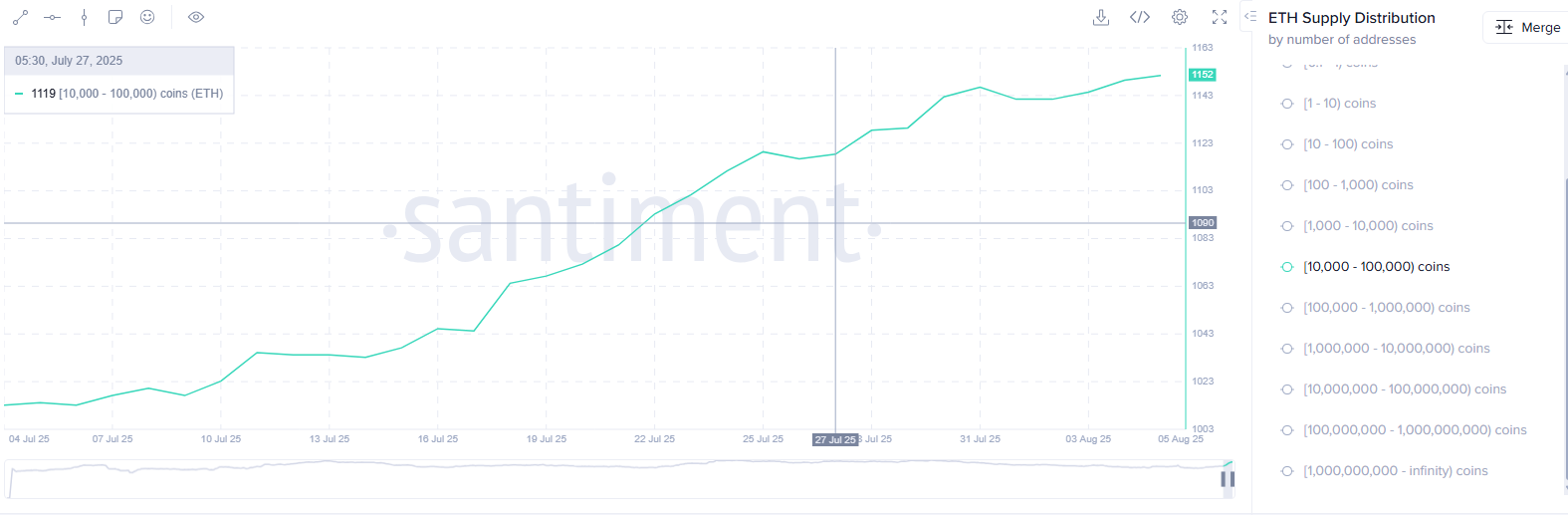

Ethereum’s rebound this week appears closely tied to renewed accumulation by whales and large entities. According to data from Santiment, the number of wallets holding more than 10,000 ETH has grown noticeably over the past few days, indicating that large holders are positioning for potential upside.

Meanwhile, on Aug. 4, two newly created addresses acquired nearly 40,000 ETH worth approximately $142 million, according to data from Lookonchain. The buying trend intensified on Aug. 5, when three additional wallets accumulated another 63,837 ETH valued at around $236 million.

In total, Lookonchain reports that 14 fresh whale wallets have collectively accumulated over 856,000 ETH, worth nearly $3.16 billion, over just two days.

This scale of accumulation, particularly from new wallets, often signals growing conviction from high-net-worth individuals or institutional actors. These buyers typically take longer-term positions and accumulate ahead of expected price appreciation. Their activity is also closely watched by retail traders, who often interpret such moves as a bullish signal.

In addition to whale buying, institutional interest in Ethereum is also gaining momentum. There has been a noticeable uptick in treasuries and structured products centered on ETH.

One of the most prominent developments is the growth of the Strategic Ethereum Reserve (SER), which tracks institutional Ethereum holdings across major funds, treasuries, and asset managers.

Just six weeks ago, the SER’s total assets under management stood below $3 billion. That figure has now surged to over $10.8 billion, and the reserve controls 2.45% of ETH’s total supply, up from just 1% in June.

Contributing to this surge, SharpLink, a Nasdaq-listed gaming firm and one of the top holders within the SER, added 18,680 ETH worth approximately $66.63 million to the reserve on Aug. 4. This move signals that corporate treasuries continue to see Ethereum as a strategic long-term asset.

What’s next for ETH?

Despite the significant whale accumulation and renewed institutional buying, Ethereum still lacks the momentum needed to decisively break above the $3,800–$3,900 resistance zone.

While fresh capital has re-entered the market through new whale wallets and treasury allocations, these inflows have yet to translate into a broad shift in market sentiment.

Last week, Ethereum-focused ETFs saw outflows totaling $129 million, which indicates that mainstream investors are still hesitant, and macroeconomic uncertainty, ranging from trade war risks to concerns over the U.S. labor market, continues to weigh on risk assets.

Without a clear narrative or short-term catalyst, the current rally remains vulnerable to reversal.

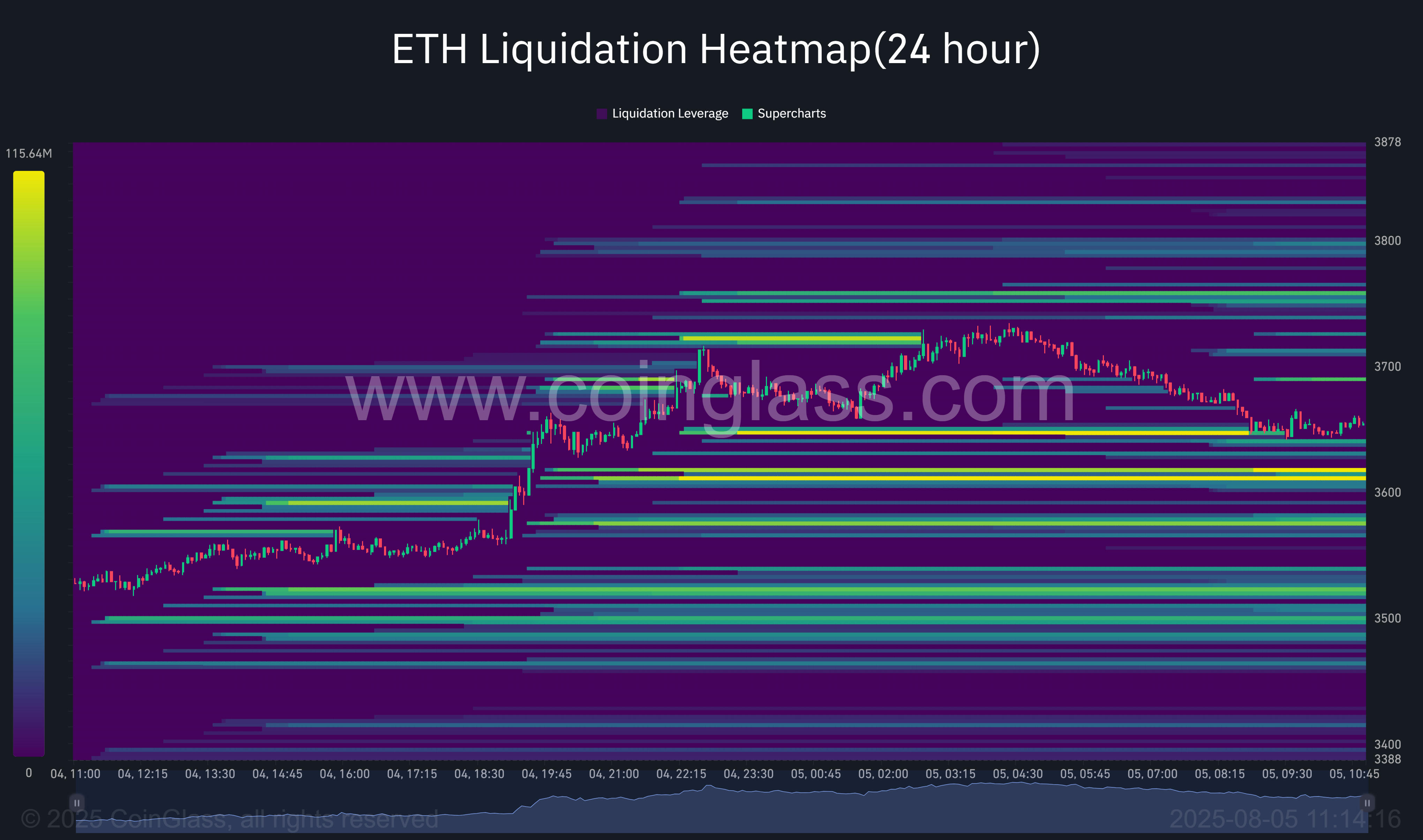

Data from CoinGlass suggests that Ethereum is trading precariously close to a dense cluster of long liquidation levels between $3,620 and $3,660. This zone, illuminated by high-intensity bands on the 24-hour heatmap, represents a large concentration of overleveraged long positions that could be forced out if ETH slips further.

This setup introduces a short-term downside risk. If Ethereum fails to hold above the $3,650 mark, a move into the $3,620–$3,660 pocket could trigger cascading liquidations.

Such a scenario would likely intensify selling pressure, pushing ETH closer to secondary liquidity pools near $3,580 or even $3,540, where additional long positions are vulnerable. These levels act as liquidity magnets, meaning price may gravitate toward them to “harvest” open positions before rebounding.

Conversely, if bulls manage to defend the current support zone and spark a short-term rebound, Ethereum may target short liquidation clusters near $3,730–$3,780.

Yet some market watchers expect Ethereum’s recovery to $4,000, supported by bullish technicals.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

crypto.news

#Ethereum #break #whales #institutions #load