Applied Materials (AMAT) will release its fiscal first-quarter 2026 earnings on Thursday, Feb. 12. AMAT stock has gained significantly, rising about 30% year-to-date (YTD) and over 81% in 12 months. The rally in AMAT stock is supported by artificial intelligence (AI)-driven demand.

The broader semiconductor equipment market is currently enjoying a strong upcycle, driven largely by massive investments in AI data centers. As hyperscalers and chipmakers race to build capacity for more powerful and energy-intensive workloads, demand for advanced manufacturing tools has surged. Applied Materials, as one of the world’s leading suppliers of wafer fabrication equipment, is benefiting from this trend.

Its tools are essential for producing cutting-edge chips used in AI accelerators and data center servers. Moreover, Applied Materials’ equipment is used to produce chips for automobiles, consumer electronics, and a wide range of industrial applications.

Heading into the earnings report, sustained customer demand and favorable industry conditions could continue to support its top line. However, margin pressure could dampen near-term enthusiasm for the stock.

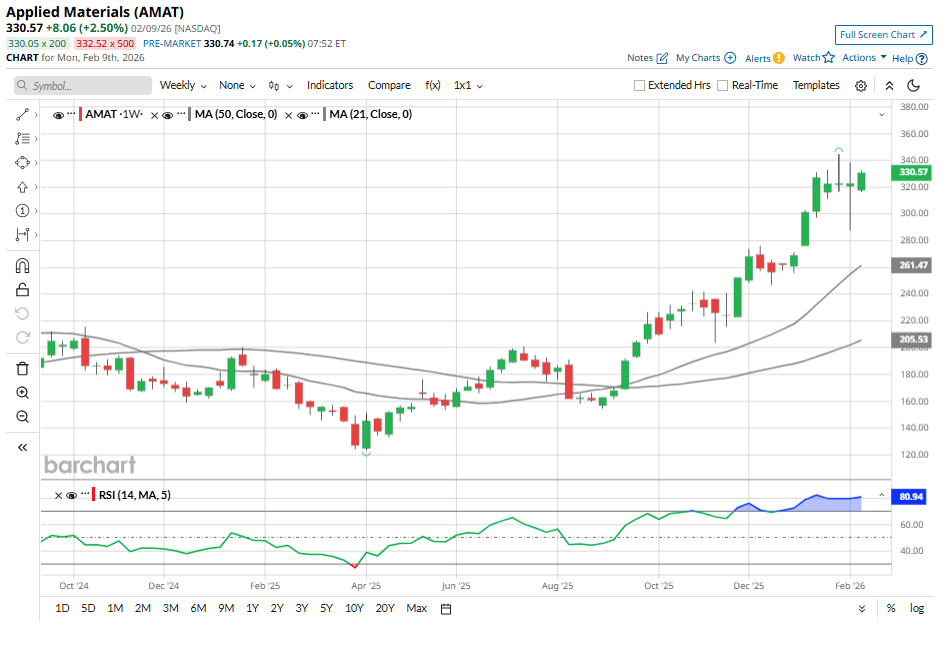

Valuation and technical signals also suggest caution may be warranted. Applied Materials’ 14-period Relative Strength Index currently sits near 80.9, well above the 70 threshold typically associated with overbought conditions. This indicates that much of the optimism may already be priced into the shares.

Adding to the uncertainty is the stock’s recent post-earnings behavior. Applied Materials shares have declined following earnings releases in each of the past four quarters, including a 3.3% drop after the most recent fourth-quarter report.

Applied Materials’ first-quarter financials will continue to benefit from the increased demand for AI compute capacity. Over the past year, the company has expanded its technological capabilities, refined its product lineup, and streamlined operations, positioning itself well to capture rising investment in advanced chips.

Management expects first-quarter revenue of about $6.85 billion, with the bulk, about $5.03 billion, coming from its Semiconductor Systems segment. Applied Global Services (AGS) revenue is projected to contribute around $1.52 billion. Strong capital spending by AI-focused data centers is supporting demand for the company’s advanced tools.

finance.yahoo.com

#AMAT #Stock #Maintain #Momentum